If your business sends money internationally, you’re paying a steep penalty for complacency.

You initiate a $100 cross-border transfer, and it arrives three to five days later, saddled with $20-$50 in opaque fees after bouncing through a chain of 5-10 intermediary banks. If the payment stalls, you have zero visibility and a regulatory headache.

Meanwhile, instant reality is already here: Users in India, Brazil, Thailand, and Singapore transfer funds across borders faster than most Western domestic banks can manage. They are moving money across international lines with the efficiency of a text message.

The gap between legacy finance and the new wave of Real-Time Payment (RTP) corridors is now a competitive chasm.

The Fatal Flaw of Traditional Wires

The current cross-border payment system is a relic designed for a pre-digital age, imposing massive hidden costs far beyond the direct fees.

When you hit ‘send,’ your money immediately enters a multi-day holding pattern:

- Day 1: Your bank initiates the wire and charges its fee.

- Days 2-4: The payment is chained through multiple correspondent and intermediary banks, each adding a delay, a fee, and a point of failure.

- Day 5+: The funds finally clear at the recipient’s bank.

Total Cost: $20-$50+ per transaction.

Total Time: 3-5 business days.

The cost goes far beyond these metrics. A multi-day settlement window exposes your capital to unnecessary FX volatility, your margin can be erased by currency shifts before the payment even clears.

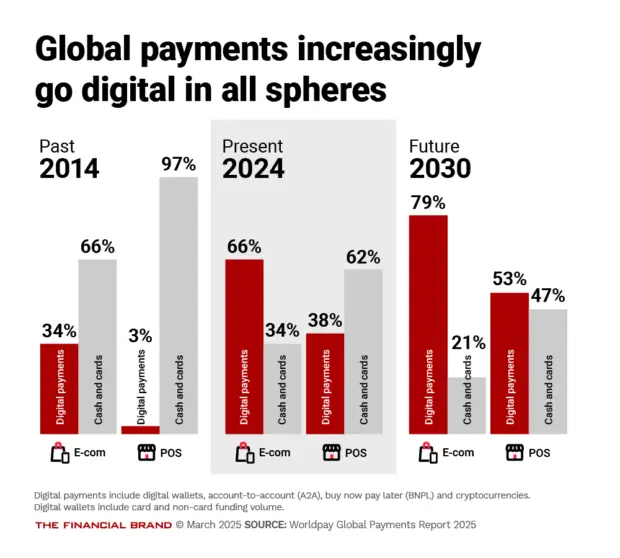

The Global RTP Takeover

While the West lags, the rest of the world is transitioning to real-time. This isn’t future-gazing, it’s the present market reality.

The global RTP market is soaring toward $116 billion by 2029, driven by 35% annual growth. This market dominance is being built on direct, instant corridors:

- India: 84% of all electronic payments are already real-time via the UPI system.

- Brazil: Its Pix system is a global benchmark, projecting over 115 billion transactions by 2028.

- ASEAN: The PayNow (Singapore) and PromptPay (Thailand) connection allows instant cross-border transfers using only a mobile number.

- Europe: The ECB’s Project Nexus is actively exploring how to connect its instant payment system (TIPS) with other major global economies, aiming for instant cross-continent payments within a few years.

Economics and the Working Capital Edge

The cost saving of intelligent routing through these corridors is transformative to your bottom line.

| Metric | Traditional Correspondent Banking | Instant Payment Corridors |

|---|---|---|

| Intermediaries | 5–10 banks | Direct System Connectivity |

| Transaction Fee | $20–$50+ | $10–$20 (or less) |

| Settlement Time | 3–5 Days | Real-Time (Seconds) |

This differential delivers 30-40% fee reductions for merchants. The resulting speed directly impacts working capital efficiency. For any enterprise, instantaneous settlement drastically reduces the need for large cash reserves to cover the 3-5 day float, immediately freeing up millions tied up in the payment pipeline.

OmniDirector

OmniDirector is the smart system that makes real-time optimization possible. It replaces slow, fixed banking processes with quick, flexible decisions made every moment.

1. Intelligent Multi-Corridor Routing

OmniDirector doesn’t stick to one route. For every transaction, it checks things like success rates, costs, exchange rates, network traffic, and location. This helps it pick the fastest, cheapest, and most reliable path in just a split second.

2. Dynamic Path Selection & Failover

The system is smart and keeps learning. If the main payment route to Singapore is busy, OmniDirector automatically picks a faster, more reliable, and cost-effective route. And if the main connection suddenly fails, it instantly switches to another route, like through Singapore or Malaysia, keeping transactions running smoothly with a 99.99% success rate and no loss in revenue.

3. Real-Time Compliance Enforcement

Every country has unique, strict requirements, whether it’s UPI’s transaction caps, Pix verification rules, or regional authentication mandates. OmniDirector provides Real-Time Compliance Enforcement, automatically validating and enforcing these rules pre-transaction. This eliminates manual audits and greatly reduces your risk of non-compliance fines or payment freezes.

OmniReplicator

Instant payment systems need to work perfectly all the time. Even a 10-minute downtime can lead to millions lost in failed transactions and seriously hurt a company’s reputation.