Accelerating Settlement with T+0 and Real-Time Payment Processing

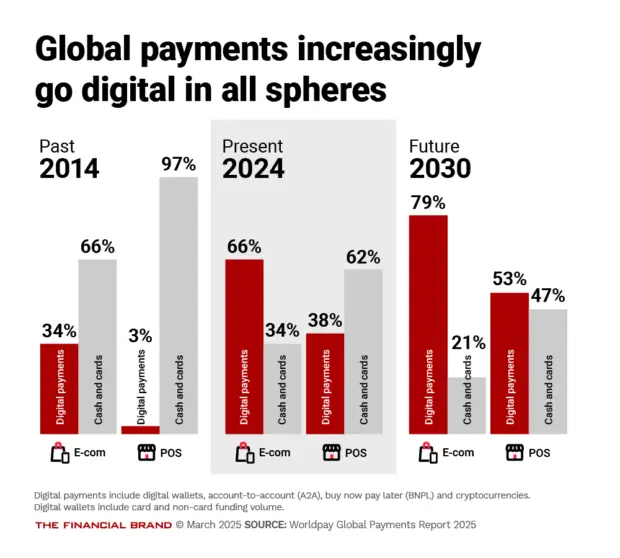

Global settlement cycles are compressing at unprecedented speed. As markets move from T+2 to T+1—and increasingly toward T+0—banks and payment processors must modernize batch-based systems to support real-time clearing, liquidity visibility, and 24/7 operations.

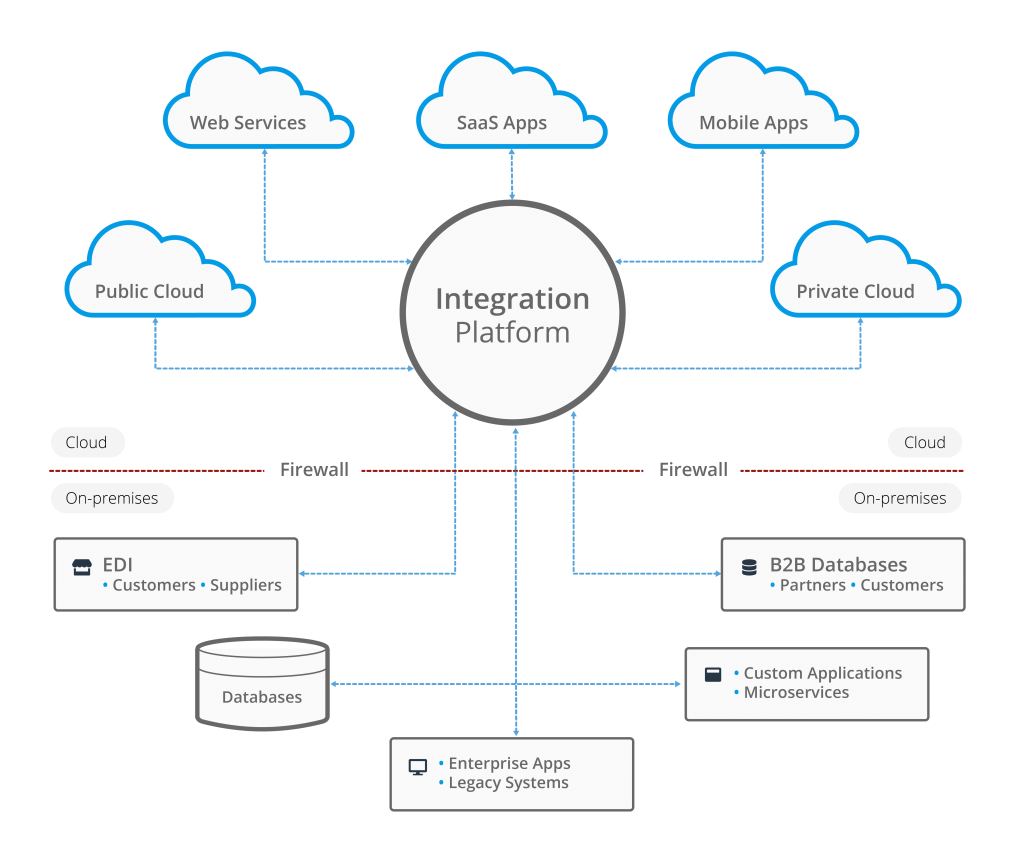

Building Scalable Payment APIs: Microservices Architecture for Modern Processors

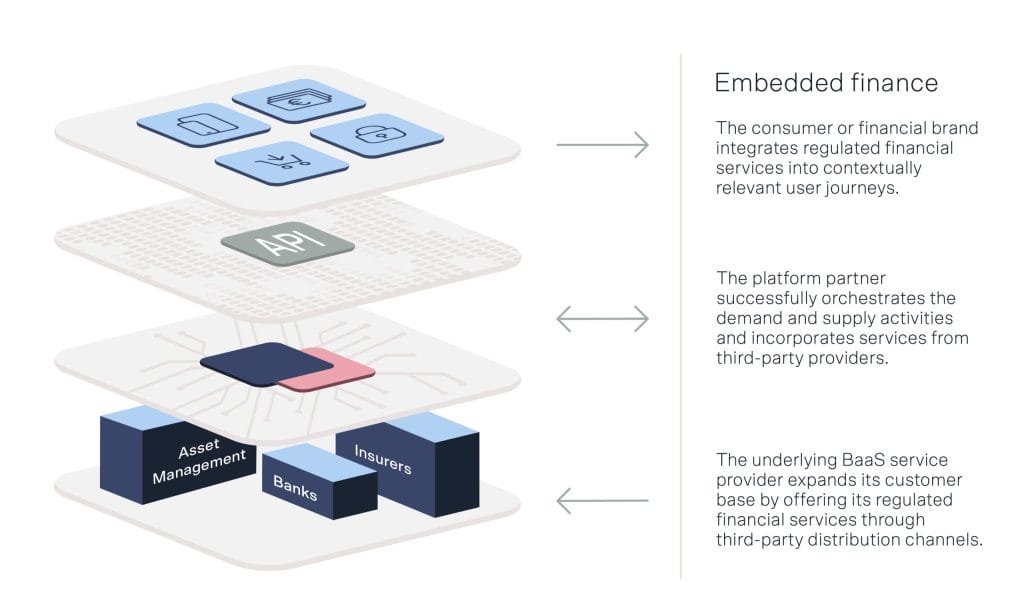

As embedded finance reshapes how payments are delivered, API-first and microservices-based platforms have become essential. Payment processors that adopt modular, developer-friendly architectures can scale faster, integrate seamlessly, and remain competitive in a rapidly evolving financial ecosystem.

Disaster Recovery and Business Continuity in Payment Systems: A Practical Implementation Guide

Learn how payment processors and banks design BCDR strategies to meet regulatory demands and ensure continuous transaction processing.

Stand-In Processing and Fallback Authorization: Keeping Payments Moving 24/7

When issuer systems go offline, payment failures can cost merchants millions and erode customer trust. Stand-in processing ensures transaction continuity during outages by allowing networks to approve payments under controlled risk rules—making it a cornerstone of modern payment resilience.

Embedded Finance & Payment-as-a-Service

Building a custom payment system can take seven months, cost hundreds of thousands, and delay revenue. Payment-as-a-Service lets platforms launch faster, reduce costs, and embed secure payments in weeks—not months.

Multi-Rail Payment Architectures: The Future of Payments

Single-rail payment systems limit flexibility, increase costs, and drive revenue loss. A multi-rail architecture brings cards, ACH, wires, and real-time payments into one intelligent platform—boosting acceptance rates, lowering fees, and simplifying operations.

The Instant Payments Revolution: Why Your Bank Is Failing You

Traditional cross-border wire transfers are slow, expensive, and opaque—tying up working capital and exposing businesses to unnecessary risk. In this article, we explore how real-time payment corridors are replacing correspondent banking and how intelligent routing is unlocking faster, cheaper, and more reliable international payments.

The Quantum Time Bomb: Your Data is Already Being Stolen

Quantum computing is no longer a distant threat. Attackers are already harvesting encrypted data today with the intent to decrypt it tomorrow. In this article, we explain why traditional encryption is becoming obsolete, what “Harvest Now, Decrypt Later” really means, and how quantum-safe cryptography is redefining security for payment systems and financial platforms.

Why Your Payment System Is Failing (And How Microservices & SOA Can Save You Millions)

Monolithic payment systems may have worked in the past, but today they slow innovation, increase risk, and drive up costs. In this article, we explore why microservices and service-oriented architecture are transforming payment platforms—enabling faster innovation, independent scaling, and resilient, always-on transaction processing.

Active-Active NonstopX: Simple Guide to Reliable Payment Systems

Traditional POS systems are slow, expensive, and outdated. SoftPOS lets merchants accept secure contactless payments anywhere using only a smartphone—no terminals required.