The way we handle payments is changing fast, and old payment systems were built as one big machine. But they’re too slow for what businesses need today. Modern companies want flexible systems that connect easily with other apps through APIs (digital bridges that help programs talk to each other).

In 2025, embedded finance is worth $148.38 billion and is expected to grow to $1.73 trillion by 2034. This rapid growth is driven by API-based systems that let people pay, borrow, and manage accounts directly within their favorite apps without switching platforms.

Payment companies using old systems are getting left behind and could be replaced. Those using newer, flexible systems are better positioned to work with growing fintech companies, online marketplaces, and digital banks.

Why Microservices Matter in Payment Processing

Traditional monolithic payment systems centralize all processing logic in a single deployment unit. While this approach once simplified operations, it now introduces material constraints. Any functional change requires full-system testing and redeployment.

When you are scaling, old payment systems cause lots of hurdles. If one part gets overloaded, you must upgrade everything—like replacing a whole car for one bad tyre. Adding features becomes slow because teams must coordinate carefully across the shared system.

What microservices do:

- Split payment platforms into separate, independent services

- Connect these services through clear APIs

- Give each service one specific job (like authorization, routing, fraud detection, clearing, or settlement)

Why this matters:

- Teams can scale individual services without touching others

- Updates happen faster since changes don’t affect the whole system

- Broken or outdated components can be replaced easily without disrupting everything else

Different services can use technologies optimized for their workloads. Failures are isolated rather than systemic. Third-party integrations become simpler. Cost models shift toward pay-for-use rather than perpetual overprovisioning.

OmniPayments’ service-oriented architecture applies these principles through modular components such as OmniSwitch, OmniDirector, OmniCompensator, and OmniSecurity, allowing processors to deploy only what they need while preserving enterprise-grade resilience.

API-First Design as a Competitive Requirement

API-first architecture treats APIs as primary products rather than integration afterthoughts. API contracts are designed before backend implementation, ensuring interfaces reflect customer needs rather than internal system structures. This approach forces clarity, consistency, and long-term stability.

Developer experience becomes a core capability. Clear documentation, versioned APIs, SDKs, sandbox environments, and predictable error handling are no longer optional. Payment services must also be composable; developers should be able to consume authorization, settlement, or reporting independently based on their use case.

Microservices Layers in Modern Payment Platforms

A typical microservices-based payment architecture is organized into logical layers. The transaction processing layer handles authorization, switching, intelligent routing, and stand-in processing, scaling dynamically during peak demand. The risk layer evaluates fraud, compliance, and transaction risk in real time using rules engines and machine learning models.

Clearing and settlement services consolidate transactions, perform netting, orchestrate fund movement, and reconcile outcomes.

Data services manage transaction logs, analytics, encryption, tokenization, and backups.

Operational services provide monitoring, alerting, logging, and API gateway functions that enforce authentication, throttling, and request governance.

Security Patterns for Payment APIs

Modern payment systems employ multiple layers of security to ensure their safety. First, tools like OAuth 2.0 and mTLS act as digital ID checkers, and they ensure that only authorized individuals and programs can access the system.

Competing in the Embedded Finance Era

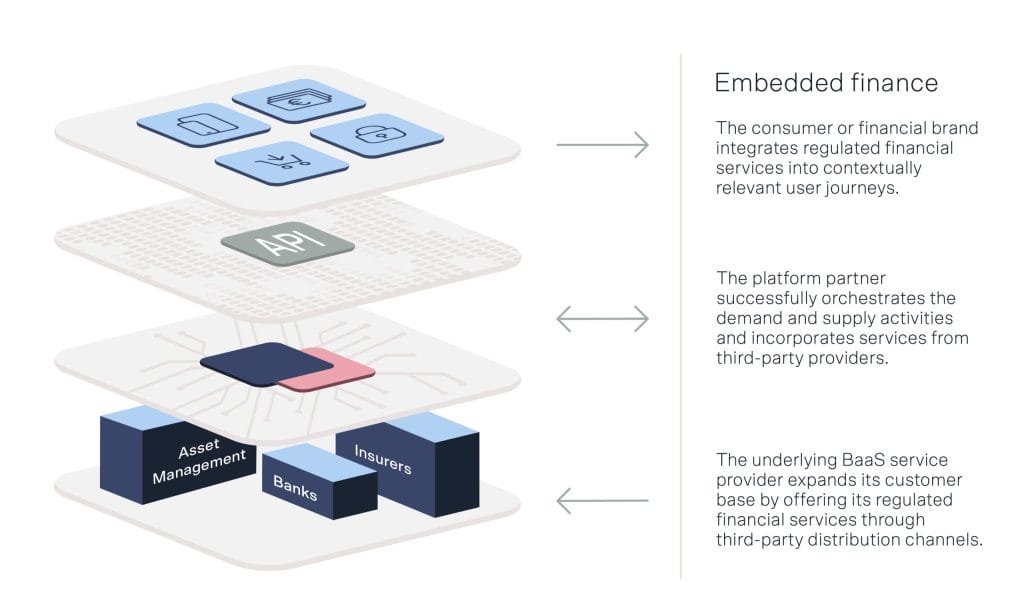

Embedded finance has redefined how payment services are consumed. E-commerce platforms embed lending. Marketplaces embed banking. Accounting software embeds payments. In each case, APIs, not standalone payment portals, are the delivery mechanism.

Processors that offer flexible payment, account, and real-time notification APIs become true infrastructure partners, not just backend providers.

Conclusion

Processors that build modular, developer-friendly platforms for embedded finance will drive the next phase of growth. Those that do not will be pushed into price-based competition in a market that no longer rewards rigid systems.