Blog

Accelerating Settlement with T+0 and Real-Time Payment Processing

Global settlement cycles are compressing at unprecedented speed. As markets move from T+2 to T+1—and increasingly toward T+0—banks and payment processors must modernize batch-based systems to support real-time clearing, liquidity visibility, and 24/7 operations.

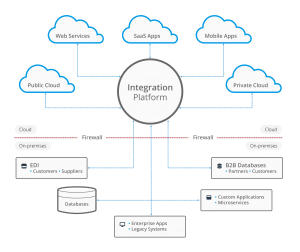

Building Scalable Payment APIs: Microservices Architecture for Modern Processors

As embedded finance reshapes how payments are delivered, API-first and microservices-based platforms have become essential. Payment processors that adopt modular, developer-friendly architectures can scale faster, integrate seamlessly, and remain competitive in a rapidly evolving financial ecosystem.

Disaster Recovery and Business Continuity in Payment Systems: A Practical Implementation Guide

Learn how payment processors and banks design BCDR strategies to meet regulatory demands and ensure continuous transaction processing.

Stand-In Processing and Fallback Authorization: Keeping Payments Moving 24/7

When issuer systems go offline, payment failures can cost merchants millions and erode customer trust. Stand-in processing ensures transaction continuity during outages by allowing networks to approve payments under controlled risk rules—making it a cornerstone of modern payment resilience.

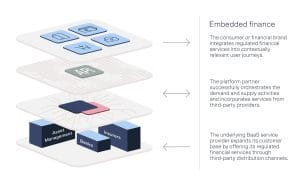

Embedded Finance & Payment-as-a-Service

Building a custom payment system can take seven months, cost hundreds of thousands, and delay revenue. Payment-as-a-Service lets platforms launch faster, reduce costs, and embed secure payments in weeks—not months.

Multi-Rail Payment Architectures: The Future of Payments

Single-rail payment systems limit flexibility, increase costs, and drive revenue loss. A multi-rail architecture brings cards, ACH, wires, and real-time payments into one intelligent platform—boosting acceptance rates, lowering fees, and simplifying operations.